Choosing the right VC monitoring software can save time, improve compliance, and provide actionable insights for better portfolio management. Here's what to look for:

- Real-time dashboards: Monitor KPIs, market trends, and financial metrics instantly.

- Custom reporting tools: Generate tailored reports for LPs, ESG metrics, and performance tracking.

- Compliance features: Ensure GDPR, SOC 2, and AML/KYC standards with audit trails and automated checks.

- Workflow automation: Reduce manual tasks with integrations, automated reminders, and data enrichment.

- API compatibility: Seamlessly connect with tools like Power BI, Tableau, and fund accounting systems.

Key platforms include:

- Zapflow: Modular pricing, unlimited users, strong compliance tools.

- Carta: Cap table management, valuations, and tax services.

- Affinity: AI-driven relationship mapping and mobile CRM.

- DealCloud: Tailored for deal tracking and pipeline management.

- PitchBook: Market data and investment analysis.

- Altvia: Centralised portfolio metrics and AI insights.

- Ledgy: Live ownership updates and equity workflows.

- Cobalt LP: Advanced analytics and PME benchmarking.

Quick Tip: Focus on integration capabilities, ease of use, and scalability to match your firm's needs. The right platform can streamline operations, enhance decision-making, and meet compliance requirements.

1. Zapflow

Real-time data monitoring and dashboards

Zapflow keeps a constant eye on KPIs, market trends, and operational stats to give a clear picture of portfolio health. Its dashboards are designed to adapt, featuring custom widgets and tailored views that cater to specific roles or fund performance needs. By automating updates, it significantly cuts down on the time spent on manual quarterly reporting.

The platform doesn’t just focus on the present; it also lets teams compare historical data with real-time metrics. This combination helps users quickly identify performance trends and uncover opportunities for value creation. Trusted by over 1,500 investment professionals globally, Zapflow is known for its quick setup, often taking less than a week to implement.

In addition to its dashboards, Zapflow offers robust reporting tools that adapt to various needs.

Customisable reporting and analytics tools

Zapflow simplifies portfolio monitoring with flexible templates that track performance metrics unique to each firm. Web forms and structured surveys make it easier to collect both quantitative and qualitative data from portfolio companies, saving analysts from tedious manual data entry. For those focusing on ESG metrics, the platform provides tailored surveys that guide respondents to deliver structured, relevant information.

Its advanced visualisation tools create stakeholder-ready reports optimised for any device. Plus, Zapflow integrates with business intelligence platforms like Power BI and Tableau, offering deeper analytics capabilities. A value creation tracker helps teams monitor asset-level KPIs such as revenue growth, cost savings, and operational improvements, ensuring strategic initiatives are on track. With Excel integration, users can easily import and export data, keeping workflows smooth and uninterrupted.

To complement its analytics features, Zapflow also prioritises compliance and risk management.

Compliance and risk management features

Zapflow has been ISO 27001 certified since 2020 and ensures compliance with GDPR and SOC 2 standards. It includes automated KYC/AML checks, sanction screenings, and detailed audit trails with precise access controls. Security measures like encryption (both at rest and in transit), multifactor authentication (via SMS or Google/Microsoft Authenticator), single sign-on (SSO), and YubiKey support further bolster its reliability.

The platform also excels in integrating with other tools and automating workflows.

API integrations and workflow automation

Zapflow’s REST API allows seamless data sharing across various systems, including eFront and iLevel, while also supporting BI tools like Power BI and Tableau. Custom web forms embedded on websites automatically capture new investment opportunities, triggering tasks like creating profiles for deals, companies, or contacts. Automated data enrichment pulls accurate details from official registries, minimising manual input. Its modular design lets teams start with deal flow management and expand into fundraising or portfolio management as their needs evolve. Features like bulk editing and duplicate detection ensure data accuracy while reducing the time spent on database clean-up.

"Zapflow is one of the key tools we use in our day-to-day work. It enables us to do everything from deal flow tracking to portfolio reporting." - Cyril Vancura, imec.xpand

2. Carta

Real-time data monitoring and dashboards

Carta offers a centralised investments dashboard that helps venture capital firms keep track of their holdings across multiple funds. It also provides in-depth analysis of individual portfolio companies, making it easier to understand performance trends. The platform’s portfolio events feed delivers updates in real time, covering key activities like equity issuances, valuation changes, and new funding rounds - eliminating the need for outdated spreadsheets. With customisable dashboards, fund managers can maintain visibility over their investments and even share insights directly with limited partners. Automated tracking features cover essential fund metrics such as IRR, TVPI, DPI, and MOIC, alongside company-specific indicators like ARR, EBITDA, burn rate, and cash runway.

"Monitoring the performance of a portfolio allows fund managers to track the progress of their portfolio companies, locate potential problems, and strategise for a future exit or other financial milestones." – Kevin Dowd, Senior Writer, Carta

Customisable reporting and analytics tools

Carta goes beyond simple monitoring by offering powerful reporting tools designed for deeper analysis. Currently managing over 8,800 funds and SPVs, the platform provides features like fund forecasting and scenario modelling. This enables users to visualise the financial outcomes of potential exits at varying valuations. The fund admin portal offers easy access to critical metrics, including net and deal IRR, gross returns, and overall fund health. Its valuations tool simplifies data collection and reporting for ASC 820 and 409A valuations, ensuring fair market value is accurately assessed. For professionals on the move, the Carta Carry app allows fund performance tracking anytime, anywhere. As Jeffrey Lee, Managing Director & CFO at NLVC, explains:

"Our LPs have much higher satisfaction, they can self-help by logging in to get what they want, discovering it faster".

Compliance and risk management features

Carta incorporates essential compliance tools, including AML/KYC services, investor validation, global sanctions checks, and ongoing due diligence screening. Its audit confirmation tool simplifies annual audit processes and supports ASC 820 valuations, ensuring GAAP-compliant reporting. By prioritising recent transaction prices, the platform provides accurate fair value assessments for financial statements. Additionally, fund tax services handle year-end tax timelines, federal tax returns (Form 1065), and K-1 distributions, easing the burden of tax compliance.

API integrations and workflow automation

Carta’s platform seamlessly integrates with existing systems, making fund operations more efficient. The portfolio events feed automates updates on activities like equity issuances and funding rounds, reducing manual data entry. Its API ecosystem enables teams to incorporate Carta’s data into internal workflows, creating a unified and streamlined operational process.

3. Affinity

Real-time data monitoring and dashboards

Affinity’s real-time dashboards make it easy to keep a pulse on your portfolio. From tracking deal flow and fundraising rounds to uncovering relationship insights, these dashboards provide live updates that help professionals stay ahead. Powered by AI, the platform delivers instant updates on valuation changes and mutual connections, helping users identify trends as they happen. The mobile app ensures you can access CRM data and dashboards wherever you are. For instance, integrating real-time ownership data has allowed some firms to cut down on reporting time by automating updates for over 100 portfolio companies. These features lay the groundwork for creating tailored reporting tools.

Customisable reporting and analytics tools

Affinity simplifies reporting with automated tools that generate custom tear sheets, performance dashboards, and updates for limited partners (LPs). These reports are built around the metrics that matter most to your firm, reducing the need for manual data entry. Its AI-driven relationship intelligence goes a step further by mapping connections and interests, offering practical insights to improve deal sourcing and portfolio oversight. The platform’s compatibility with multiple systems also makes it easy to share updates with stakeholders on the fly.

Compliance and risk management features

For firms navigating complex compliance landscapes, Affinity provides essential tools. It offers audit-ready cap table management and valuations that meet IRS standards, while also adhering to SOC 2 and GDPR requirements. This makes it particularly suitable for UK-based firms managing portfolios in £ and meeting FCA regulations. Clear audit trails within its stakeholder communication tools further reduce risks associated with LP reporting and equity management, ensuring a smoother compliance process.

4. DealCloud

Real-time data monitoring and dashboards

DealCloud takes a focused approach to data analytics, offering dashboards specifically designed for venture capital processes. These dashboards bring together proprietary data and third-party market intelligence sources like PitchBook and Preqin. They help firms track key metrics such as deal pipeline speed, sector exposure, and intermediary relationships. The dashboards also provide real-time insights into portfolio health and available funds ("dry powder") as deals move through different stages. This up-to-the-minute data seamlessly integrates with advanced reporting tools for better decision-making.

Customisable reporting and analytics tools

With DealCloud’s Reporting Template Builder, firms can create branded, automated reports directly within Microsoft Word and Excel. Templates pull live data from the system, making it easy to produce investment memos, quarterly reports for limited partners, and tear sheets. The platform’s analytics tools go a step further, enabling firms to evaluate deal sourcing efficiency and intermediary performance. This ensures that reports highlight the metrics most relevant to stakeholders.

API integrations and workflow automation

DealCloud’s API capabilities connect data from various systems - such as CRMs, fund accounting platforms, and spreadsheets - into one unified platform. This integration creates a single source of truth, simplifying data management. Automated workflows further streamline operations by handling tasks like data collection, tracking progress, and sending reminders. This allows investment professionals to dedicate more time to strategic decision-making.

5. PitchBook

Real-time data monitoring and dashboards

PitchBook offers a powerful tool for private capital market analysis, providing venture capital firms with the ability to track market trends and uncover new opportunities as they happen. Its Analyst Workspaces simplify the process by organising market data efficiently, while Market Maps offer clear visualisations of competitive landscapes and industry developments. By leveraging AI-powered data extraction and tracking, the platform speeds up the delivery of insights, enabling firms to benchmark investments, assess asset classes, and evaluate fund strategies using both current and historical data. This approach not only helps measure risk but also pinpoints promising entry points. Additionally, the Research Centre acts as a centralised hub, giving users access to comprehensive financial data and analysis across both private and public markets. This real-time monitoring lays a strong foundation for more in-depth analysis.

Customisable reporting and analytics tools

PitchBook goes beyond monitoring by offering advanced reporting and analytics tools that refine data interpretation. It serves as a go-to platform for detailed financial analysis, covering both private and public markets. Investment professionals can derive actionable insights from market trends and key metrics, empowering them to make well-informed decisions. These tools are designed to enhance data-driven strategies, with features that identify patterns and predict outcomes. By enabling teams to perform thorough market analysis and investment research, PitchBook supports forward-thinking strategies. Notably, forecasts indicate that over 75% of firms are expected to integrate artificial intelligence into their workflows by 2025, further amplifying the platform’s relevance.

sbb-itb-d63e044

6. Altvia

Real-time data monitoring and dashboards

Altvia addresses the challenge of scattered spreadsheet data by bringing all portfolio metrics - like financials, KPIs, and board decks - into one centralised hub. With Altvia, you can easily track key metrics such as ARR, margins, and headcount, using flexible filters to sort by fund strategy, vintage, or company. The platform's live dashboards offer real-time visualisation, giving VC teams a clear view of performance and trends throughout the entire fund lifecycle. This dynamic visualisation simplifies reporting and supports smoother workflow processes.

Customisable reporting and analytics tools

Altvia makes creating Quarterly Business Reviews and board decks a breeze by pulling data directly from its centralised system. The platform’s analytics tools enable teams to compare fund performance across different vintages or strategies, helping to pinpoint top-performing assets. Additionally, Altvia’s AI-powered tool, AIMe, provides actionable insights to enhance fund and strategy performance. According to Altvia, users save over 200 hours annually on routine workflows, and 98% of clients rank it as their top software solution. These tailored reporting tools empower teams to make informed, data-driven decisions, perfectly aligning with the fast-paced demands of VC operations.

"Altvia is an extremely user-friendly product. Everyone in our organisation…always comments on the ease of use and accessibility." – Alexandra Lutoshkina, Team Manager

API integrations and workflow automation

Altvia takes the hassle out of repetitive tasks by automating activities like logging calls, emails, and meetings, while ensuring timely follow-ups. Its AIMe assistant boosts efficiency by extracting insights from interactions, automating workflows, and simplifying data entry with natural language prompts. Plus, with support for over 4,000 third-party integrations, Altvia ensures seamless data sharing across your existing systems.

"Altvia…helped us start small and grow into a system that has allowed us to scale whilst institutionalising our processes and staying true to our core competency." – Michael Painter, Managing Partner

7. Ledgy

Real-time data monitoring and dashboards

Portfolio monitoring has moved far beyond static quarterly PDFs. Now, live operating telemetry provides continuous, role-specific dashboards that highlight critical insights like topline trends, margin changes, customer health, and operational hiccups. This evolution brings a new level of clarity and accessibility to data.

By creating a single source of truth - where every metric can be traced back to its origin - these platforms ensure the transparency needed for confident, data-driven decision-making.

This shift to real-time monitoring turns portfolio management into a proactive process. Teams can tackle problems early and jump on opportunities as they arise, rather than reacting after the fact.

8. Cobalt LP

Real-time data monitoring and dashboards

Cobalt provides users with tailored dashboards that highlight essential metrics as soon as they log in. With a drag-and-drop interface, teams across finance, investment, and investor relations can design custom dashboard layouts to suit their needs.

One standout feature is the Data Collection Status Dashboard, which tracks portfolio company responses in real time, making quarterly reporting much more efficient. The platform also consolidates key fund metrics, value creation indicators, deal scoring, and cash flow attribution into a single, seamless system.

These dashboard tools pave the way for deeper insights and more effective analysis.

Customisable reporting and analytics tools

Cobalt’s Advanced Calculation Engine enables firms to create custom formulas and organise data by quarter, year, LTM, or fiscal periods - removing the hassle of complex Excel pivot tables. The platform automates vital venture capital performance metrics like IRR, TVPI, DVPI, and RVPI, significantly reducing the time spent on manual calculations.

Beyond this, Cobalt offers strategic analysis tools, including PME benchmarking, scenario modelling, peer analysis, and value concentration analysis. Its Excel Plug-in allows teams to effortlessly move data between existing LP reporting templates and the Cobalt database, or even upload valuation models directly back into the system.

Compliance and risk management features

Cobalt’s commitment to compliance is evident in its meticulous tracking system. Every metric change is logged with an audit trail, recording the user, time, and reason for the update. Users can also attach notes and link supporting documents to changes, ensuring a clear evidence trail for due diligence. Centralised document storage further ensures that sensitive information is only accessible to authorised personnel.

API integrations and workflow automation

Cobalt boosts operational efficiency through its API and webhook services, which integrate seamlessly with CRMs, accounting systems, third-party fund administrators, and data platforms like Snowflake and Amazon S3. Automated email sequences handle data requests and reminders, reducing the need for manual follow-ups. Additionally, Cobalt offers managed data services, with its team helping to ensure the accuracy of collected data.

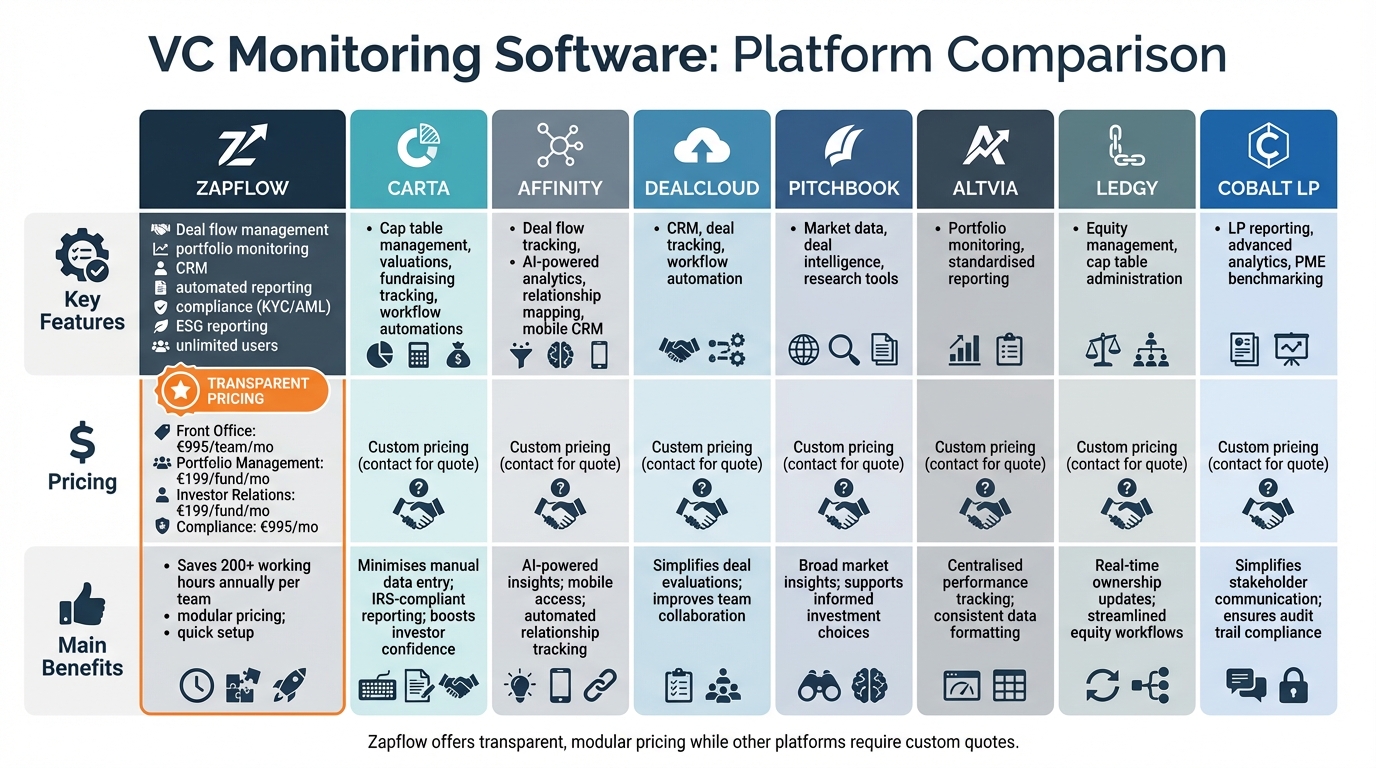

Feature Comparison Table

VC Monitoring Software Comparison: Features, Pricing & Benefits

Here's a quick snapshot of the key features, pricing, and benefits of leading VC monitoring platforms. This comparison simplifies the detailed analysis above, making it easier to pinpoint the best fit for your firm.

| Platform | Key Features | Pricing | Main Benefits |

|---|---|---|---|

| Zapflow | Deal flow management, portfolio monitoring, CRM, automated reporting, compliance (KYC/AML), ESG reporting, unlimited users | Front Office: €995/team/mo; Portfolio Management: €199/fund/mo; Investor Relations: €199/fund/mo; Compliance: €995/mo | Saves 200+ working hours annually per team; modular pricing; quick setup |

| Carta | Cap table management, valuations, fundraising tracking, workflow automations | Custom pricing (contact for quote) | Minimises manual data entry; IRS-compliant reporting; boosts investor confidence |

| Affinity | Deal flow tracking, AI-powered analytics, relationship mapping, mobile CRM | Custom pricing (contact for quote) | AI-powered insights; mobile access; automated relationship tracking |

| DealCloud | CRM, deal tracking, workflow automation | Custom pricing (contact for quote) | Simplifies deal evaluations; improves team collaboration |

| PitchBook | Market data, deal intelligence, research tools | Custom pricing (contact for quote) | Broad market insights; supports informed investment choices |

| Altvia | Portfolio monitoring, standardised reporting | Custom pricing (contact for quote) | Centralised performance tracking; consistent data formatting |

| Ledgy | Equity management, cap table administration | Custom pricing (contact for quote) | Real-time ownership updates; streamlined equity workflows |

| Cobalt LP | LP reporting, advanced analytics, PME benchmarking | Custom pricing (contact for quote) | Simplifies stakeholder communication; ensures audit trail compliance |

Zapflow stands out with its clear, modular pricing and unlimited user access, which can significantly cut costs as teams expand. Most other platforms offer custom pricing, often tailored to portfolio size or specific fund needs.

When choosing a platform, focus on options that integrate seamlessly with accounting software, market data tools, and business intelligence systems. This reduces data silos and ensures smoother workflows. Features like audit trails, multi-source validation, and automated compliance are also crucial for building trust with limited partners while maintaining strong relationships with founders through efficient data handling.

Conclusion

Selecting the right VC monitoring software is all about aligning it with your firm's specific needs. Each platform discussed here brings its own strengths to the table. For instance, Zapflow stands out with its transparent fixed-fee pricing and unlimited user access - a great option for growing teams. It also offers tools for deal flow management, portfolio monitoring, CRM, and automated compliance, turning what is often seen as a compliance task into a strategic advantage.

When evaluating options, prioritise data accuracy and integration capabilities. Look for features like audit trails, multi-source validation, and seamless integration with your existing accounting and CRM systems. These ensure your team operates from a single, reliable source of truth. If you're a UK-based firm, make sure the software complies with SOC 2 and GDPR standards to safeguard sensitive investment data.

Before making a commitment, consider your reporting needs, the complexity of your portfolio, and your firm's growth plans. The right platform should easily generate custom LP reports, track the KPIs that matter most to your stakeholders, and scale as your operations expand. The best solutions do more than just meet compliance requirements - they become strategic tools for identifying opportunities and managing risks effectively.

Finally, think about how your technology choices position your firm for the future. With over 75% of VC and private equity firms expected to adopt AI in decision-making by 2025, it’s wise to choose software that not only supports AI advancements but also strengthens relationships with founders.

FAQs

What compliance features should you prioritise in VC monitoring software?

When choosing VC monitoring software, it's crucial to focus on compliance features that make regulatory processes easier and safeguard your operations. Tools like automated KYC (Know Your Customer) and AML (Anti-Money Laundering) checks can simplify investor onboarding by cutting down on manual tasks and reducing the risk of errors. Automated workflows for collecting and validating documents are another key feature, ensuring both accuracy and time savings.

The software should also offer real-time updates on regulatory changes, keeping your firm aligned with current requirements and helping you avoid costly penalties. Equally important are strong security measures, such as advanced data encryption and strict access controls, to protect sensitive investor data and uphold trust. Together, these features enhance compliance, improve efficiency, and promote transparency in your operations.

How does API compatibility improve VC monitoring software?

API compatibility plays a key role in improving VC monitoring software by enabling smooth integration with other essential tools and platforms like financial data providers, CRM systems, and compliance software. This interconnectedness helps cut down on manual data entry, reduces the risk of errors, and ensures investment teams can rely on accurate, up-to-date information at all times.

By leveraging APIs, firms gain access to real-time data updates, allowing them to monitor portfolio performance, track deal flow, and stay on top of market trends as they happen. This seamless flow of information empowers teams to make quicker, more informed decisions and manage their operations more effectively - an essential advantage in today's fast-moving investment world. In essence, API compatibility enhances the software's ability to adapt, grow, and operate efficiently, keeping pace with the changing demands of venture capital firms.

Why is real-time data monitoring essential for venture capital firms?

Real-time data monitoring plays a crucial role for venture capital (VC) firms, enabling them to keep a close watch on their portfolio companies and react swiftly to emerging challenges or opportunities. By continuously monitoring essential financial metrics like IRR, TVPI, EBITDA, and cash burn, firms can assess whether their investments are aligned with their strategic goals.

This approach also strengthens governance, ensures compliance with regulations such as GDPR and FCA rules, and facilitates ESG monitoring - areas that are becoming increasingly important for firms operating in the UK. Access to real-time insights not only sharpens decision-making but also simplifies reporting processes and boosts transparency for stakeholders, keeping firms competitive in a rapidly evolving investment landscape.