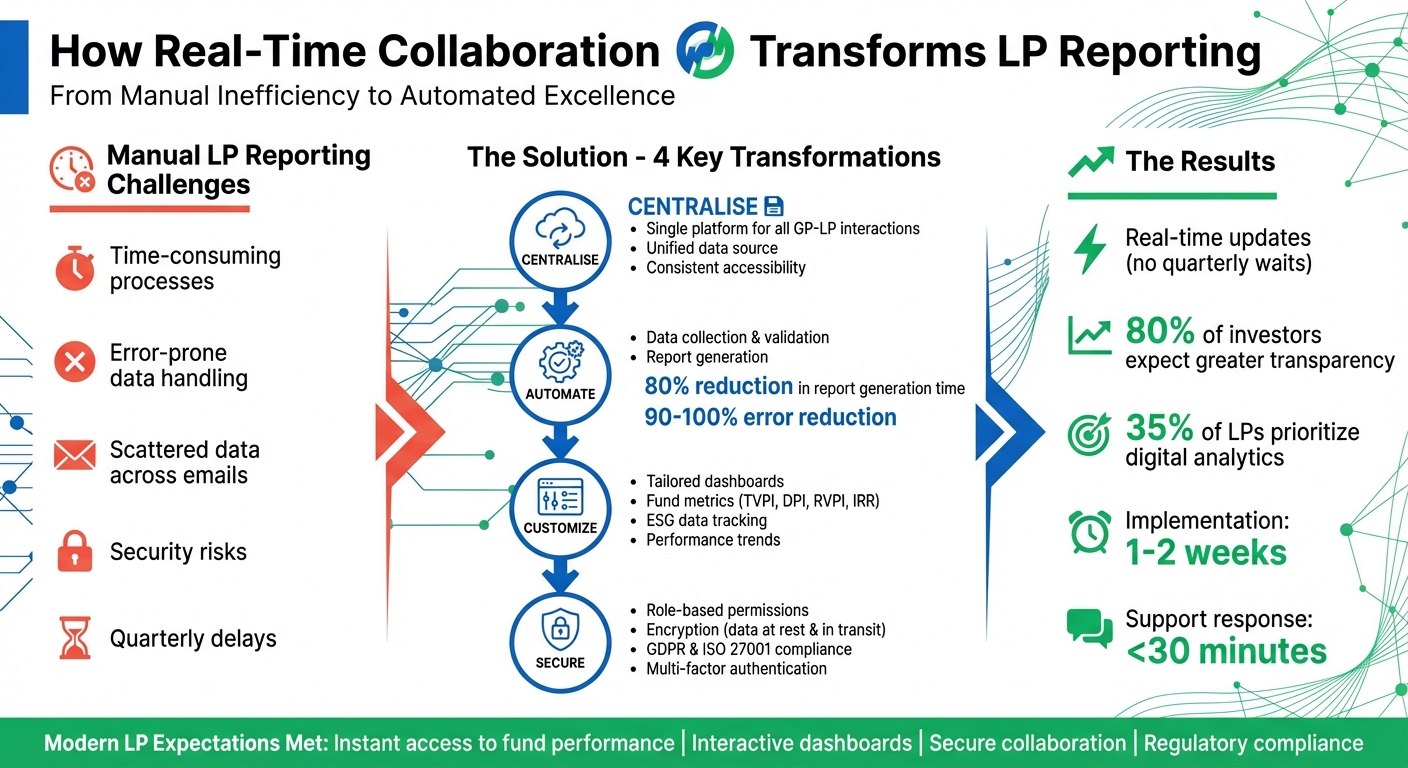

Manual LP reporting is time-consuming, error-prone, and inefficient. Investment teams often face scattered data, delays, and security risks. Real-time collaboration tools solve these issues by centralising data, automating workflows, and improving security. Platforms like Zapflow simplify LP reporting, offering features like automated data collection, custom dashboards, and secure sharing. This reduces errors and speeds up report generation, allowing teams to focus on analysis rather than admin tasks. Here's how real-time collaboration transforms LP reporting:

- Centralised Data: A single platform for all GP–LP interactions ensures consistency and accessibility.

- Automation: Data collection, validation, and report generation become faster and more accurate.

- Custom Dashboards: Tailored views for fund metrics, ESG data, and performance trends.

- Security: Role-based permissions, encryption, and compliance with GDPR and ISO 27001.

Zapflow's LP Portal is a leading example, enabling teams to eliminate inefficiencies, improve transparency, and strengthen GP–LP relationships. With features like pre-built templates, BI tool integration, and real-time updates, it’s designed to meet modern LP expectations while ensuring data security and regulatory compliance.

How Real-Time Collaboration Transforms LP Reporting: 4-Step Process

Setting Up Zapflow for Real-Time LP Data Collaboration

Zapflow Features for LP Reporting

Zapflow's LP Portal serves as a secure and centralised platform, giving investors real-time access to critical information like fund performance, capital account statements, and distribution values. This eliminates the need to wait for quarterly updates or trawl through countless emails.

The platform's customisable Report Builder streamlines the creation of quarterly, annual, and ESG reports. Using templates aligned with Invest Europe guidelines, it also allows for adjustments to meet specific regulatory or investor needs. To simplify data validation, Zapflow automates collection through tailored webforms and surveys, pulling metrics directly from portfolio companies and LPs. Each interaction is timestamped, ensuring compliance and accountability.

For those who need advanced data insights, Zapflow integrates seamlessly with BI tools and synchronises with CRM systems, keeping all communication and data logs unified and easily accessible.

Once these features are in place, the next step is configuring team access to ensure smooth and secure collaboration.

Adding Team Members and Setting Permissions

Zapflow simplifies team onboarding with the help of its Customer Success Manager, who oversees environment setup, data imports, and team training. The platform uses role-based access control, allowing for secure collaboration without compromising sensitive information.

With its flexible permissions system, Zapflow supports multiple user roles, enabling you to assign specific access levels - like read-only, edit, approve, or hidden - for different segments and attributes. For instance, sensitive data can be set to read-only to avoid accidental changes. Users can also be grouped into teams for more efficient module and pipeline management.

A notable advantage is that Zapflow doesn’t charge per user, so you can add as many team members as needed, provided they share the same permissions and access levels. Every action taken by users is automatically timestamped and logged, creating a reliable audit trail for data changes.

Using Real-Time Dashboards and Analytics

Building Custom Dashboards for LP Data

With secure team configurations in place, you can now design dashboards tailored to your fund's specific needs. Thanks to Zapflow's widget-based system, you can customise dashboards to highlight key metrics like fund multiples (TVPI, DPI, RVPI), internal rate of return (IRR), total capital commitments, and distribution values. These widgets can be arranged to serve different audiences - for instance, an internal dashboard for deal teams tracking pipeline activity or an LP-focused dashboard showcasing performance metrics.

Zapflow simplifies complex data with automatically generated charts and graphs, offering clear insights into deal pipeline activity. For teams requiring more advanced analysis, the Reporting Database add-on connects directly to external BI tools like PowerBI or Tableau, eliminating the need for manual data exports.

To keep dashboards accurate and up-to-date, custom web forms can be used to collect data directly from portfolio companies, ensuring real-time information flows seamlessly into the system.

Analysing Data to Spot Trends and Patterns

Zapflow brings together data from modules like fund management, portfolio monitoring, and deal flow into one centralised platform. This consolidated view of the investment lifecycle helps uncover trends that might otherwise remain hidden. For example, comparing historical cash flows with current KPIs can reveal performance trends and pinpoint successful investment strategies.

The platform’s visual tools transform complex financial data into easy-to-read charts, making it simpler to track portfolio health or changes in deal pipeline velocity. Additionally, by monitoring ESG survey data and compliance metrics - such as KYC and AML statuses - you can ensure alignment with both sustainability goals and regulatory standards. Comparing current performance against historical benchmarks allows for a more informed and confident approach to refining investment strategies.

Sharing Dashboards with LPs and Team Members

After creating and analysing dashboards, the next step is seamless sharing. Zapflow's LP Portal provides a secure, cloud-based platform for sharing real-time insights with both investors and internal teams. With role-based permissions, you can control dashboard visibility - granting read-only access to LPs while allowing team members to update and edit data. Sensitive sections can be hidden to maintain confidentiality without compromising transparency.

"Manage access rights with precise, role-based access controls. Grant view-only or editing permissions and hide specific information or parts from certain users." - Zapflow

Every interaction with the data is logged for accountability, and multi-factor authentication (MFA) can be enabled for added security. Unlike static PDFs, Zapflow dashboards deliver real-time updates, ensuring LPs always have the latest information on fundraising, deal flow, and portfolio performance.

Best practices for portfolio monitoring & reporting with Gale Wilkinson

sbb-itb-d63e044

Automating LP Report Generation

Automated report generation takes the efficiency of real-time dashboards to the next level, bridging the gap between data collection and actionable insights.

Automating Data Collection and Updates

Zapflow connects seamlessly with external systems like accounting software, CRMs, and portfolio databases through APIs, pulling in investment data, cash flows, and performance metrics in real time. This integration consolidates scattered data into one centralised platform, creating a reliable single source of truth. By automatically tracking changes in asset values and financial metrics, the platform slashes data collection time from weeks to mere hours, cutting report generation time by up to 80%. This means teams can shift their focus to analysis and investor relations instead of tedious data wrangling.

To ensure accurate and timely data flow, custom web forms and guided surveys collect metrics directly from portfolio companies. Automated notifications keep teams informed when reports are submitted or deadlines are approaching, ensuring nothing slips through the cracks.

Using Report Templates for Consistency

Zapflow simplifies reporting with pre-built templates for quarterly performance summaries, capital account statements, and ESG reports, all designed to align with Invest Europe guidelines. These templates automatically populate with verified data, maintaining a polished and professional format. Users can further customise reports with options for currencies (like £ for GBP), date ranges (DD/MM/YYYY), and specific metrics, ensuring every report meets their exact needs.

Early adopters have noted significant gains in efficiency and consistency. These templates not only save time but also eliminate formatting mistakes, ensuring compliance with regulatory standards without the hassle of manually reconfiguring reports each quarter.

Reducing Errors with Data Validation

Zapflow’s real-time validation tools ensure data accuracy during collection, flagging inconsistencies before reports are generated. Guided surveys incorporate automated checks to verify that metrics are in the correct format, while audit trails log every change with timestamps and user details. This meticulous system can reduce errors by 90–100%, helping firms meet UK regulations such as AIFMD with confidence.

The platform also features click-to-audit functionality within interactive cloud-grids, enabling teams to instantly verify financial data against original sources. By eliminating manual spreadsheet reconciliation, teams can trust their data's accuracy and dedicate their time to generating insights rather than chasing down discrepancies.

Best Practices for Secure LP Collaboration

Real-time LP reporting calls for strong security measures to protect sensitive data and maintain investor confidence. Here’s how Zapflow prioritises security in every interaction.

Security Measures in Zapflow

On 20th October 2020, Zapflow became the first software provider for alternative asset investors worldwide to achieve ISO/IEC 27001:2022 certification. This certification introduced a comprehensive Information Security Management System (ISMS), covering all systems and personnel.

Zapflow ensures data security through industry-standard encryption (for both data at rest and in transit), granular role-based permissions, multi-factor authentication (MFA), single sign-on (SSO), and automated audit logs - all within a protected virtual environment. These measures form the backbone of Zapflow's real-time collaboration capabilities.

Granular access controls allow general partners to define specific permissions at the document or segment level, ensuring that only authorised individuals can view sensitive information. For highly confidential data, the "Insider projects" add-on provides additional layers of control. Furthermore, application servers operate within a Virtual Private Cloud (VPC), safeguarded by firewalls.

Ensuring Regulatory Compliance

Zapflow's infrastructure adheres to UK GDPR, FCA backup, and DORA standards. Its automated Know Your Customer (KYC) and Anti-Money Laundering (AML) processes streamline verification, reducing the time required to just minutes for existing LPs and a few hours for new investors. The platform also monitors over 300 global sanction lists to verify that funds come from legitimate sources.

"With Zapflow's secure KYC onboarding process, investors can avoid sending sensitive data and documents through unsecured channels like email or fax, reducing risk of exposure." – Zapflow

The Compliance Module simplifies document collection and validation, minimising human error and cutting compliance costs. Automated prompts for documentation updates are triggered by individual investor risk profiles, ensuring compliance is maintained without manual oversight. Additionally, uploaded files undergo automatic virus scans via AWS Lambda on AWS S3, while databases benefit from multi-zone hot-swap replicas and daily automated backups stored across multiple locations.

Cultivating Collaboration and Accountability

Technical safeguards alone aren’t enough - building a culture of security and transparency is equally important for successful LP collaboration. A secure LP portal centralises communication, offering a unified view of data. Research indicates that 80% of investors now expect greater transparency from fund managers, while 35% of LPs consider advanced digital analytics crucial when assessing new managers.

Providing team members with appropriate access to data enables them to resolve issues independently, reducing the need for specialist intervention. A structured corporate calendar with clear deadlines for reports, audits, and budgets helps align teams across departments. Automated report distribution, such as sending PDF summaries ahead of weekly meetings, ensures everyone stays informed and accountable. Adopting standards like ILPA templates promotes consistency, while including narrative commentary alongside raw data helps explain performance trends and fosters trust [23,24].

Conclusion

Real-time collaboration analytics has revolutionised the way investment teams handle LP reporting. By bringing together communications, documents, and performance metrics into one secure platform, it eliminates the inefficiencies of scattered workflows. Automated tools for report generation and data validation not only minimise errors but also free up analysts to focus on deeper, strategic insights rather than repetitive tasks. This integration streamlines operations and enhances the quality of decision-making.

Modern LPs expect instant access to information, and real-time tools rise to meet this demand. Take Zapflow, for instance - a solution widely embraced by investment teams around the globe. It bridges the gap between general partners and limited partners by offering immediate access to fund performance data, capital account updates, and interactive dashboards. These features create a foundation for stronger, more transparent relationships.

Security is a critical component of this transformation. Real-time collaboration tools are built on stringent security measures, such as ISO 27001 certification, GDPR compliance, and automated audit trails, ensuring data integrity and investor confidence. Granular permission settings further safeguard sensitive information, allowing controlled access without compromising security. This focus on transparency and accountability not only boosts efficiency but also deepens trust between investors and fund managers.

The benefits extend beyond operational improvements. With implementation often completed in just one to two weeks and customer support response times averaging under 30 minutes, these tools offer a scalable solution for LP reporting. They empower investment teams to strengthen investor relationships, adapt to growing demands, and position themselves for long-term growth and success. By combining real-time analytics with top-tier security and streamlined processes, teams gain a distinct advantage in an increasingly competitive landscape.

FAQs

How does real-time collaboration enhance the efficiency of LP reporting?

Real-time collaboration allows General Partners (GPs) and Limited Partners (LPs) to seamlessly share, edit, and approve reports through a unified platform like Zapflow. This centralised approach eliminates the hassle of manual document handling, cuts down on endless email exchanges, and ensures everyone is working with the latest information.

By simplifying communication and automating key workflows, this method minimises delays, boosts transparency, and makes reporting faster and more efficient for all parties.

How does Zapflow ensure the security of sensitive data?

Zapflow takes data security seriously, employing a multi-layered approach to keep sensitive information safe. All data is encrypted both during storage and transfer, ensuring its protection at every stage. With role-based permissions, access is tightly controlled, so only authorised users can view or modify information.

The platform also includes tamper-evident storage and maintains continuous audit trails. These features log user actions, timestamps, and changes, providing transparency and aiding compliance efforts. For added control, Zapflow’s LP portal offers granular permission settings, allowing General Partners to manage who can access specific documents and reports, safeguarding investor data.

All information is stored on secure, cloud-based servers, and document sharing happens through encrypted channels. This ensures that critical files, such as financial statements and legal agreements, are transferred securely and remain protected.

How does Zapflow help maintain compliance with regulatory standards?

Zapflow simplifies compliance by automating KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, ensuring your workflows align with the latest standards set by FCA, AML, and GDPR regulations. It also offers advanced security measures and permission controls to protect sensitive information and maintain adherence to legal requirements.

What’s more, Zapflow regularly updates its features to keep pace with regulatory changes, allowing you to stay prepared for compliance challenges without diverting attention from your investment priorities.