Raising money in the venture capital (VC) sector is a complex and often challenging endeavour. Traversing the intricate web of investor relations, compliance, and competitive market dynamics requires skill and a profound understanding of the fundraising ecosystem. The procedure is laden with challenges, from identifying and involving prospective investors to managing complex due diligence processes and effectively finalizing deals. These hurdles often prolong the time required to obtain capital and affect the overall agility and growth potential of VC firms.

Enter the era of modern tools, where technology revolutionises the whole venture capital management. For instance, Zapflow's Fundraising Processor ensures seamless management of all fundraising activities. These solutions make raising capital easier and faster by streamlining the process and increasing its effectiveness. Modern tools are transforming how VC funds approach fundraising by automating critical tasks, providing comprehensive data analysis, and facilitating seamless communication.

Let’s explore how you can accelerate your venture funding efforts with the right technological solutions.

Shifting paradigms in venture capital funding

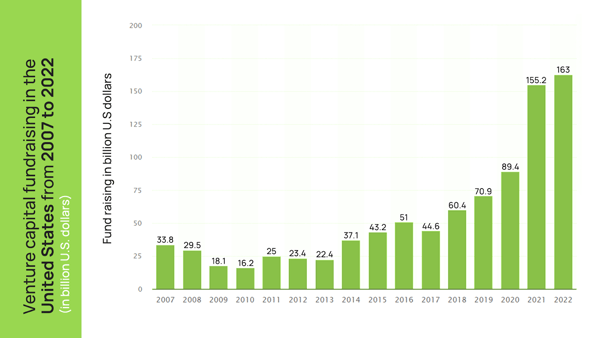

Raising a fund in venture capital has radically transformed over the past decade. A notable indicator of this change is the significant increase in the value of VC funds raised in the US, which soared from $33.8 billion in 2007 to a staggering $163 billion in 2022. This upward trajectory highlights the growing interest in VC as an investment avenue and the evolving fundraising methodologies .

Trends reshaping VC fundraising: diversity and digitalization

The venture capital fundraising outlook continuously evolves as it adapts to the changing economic climate and investor behaviour. These shifts are characterized by several key trends that are reshaping how VC firms approach the process of raising funds:

- Geographical diversification of VC activity: There's a noticeable trend of private equity moving beyond traditional hotspots like Silicon Valley. VC activity is expanding beyond traditional hubs, both in the US and worldwide. Founders are exploring new locations driven by factors like remote work and housing markets. This shift is leading to a more geographically diverse venture capital landscape, with regions outside America, particularly Asia, becoming prominent players in the VC market

- Adapting to digital evolution in fundraising: Private equity firms are harnessing the power of technology to connect with potential investors known as limited partners (LPs). This includes utilizing specialized digital platforms that extend beyond traditional social media. These platforms are designed for investor engagement, integrating features like targeted outreach, analytics-driven marketing strategies, and interactive digital content. The approach broadens the investor base and allows for more strategic and effective communication, ensuring potential investors are reached through the most impactful channels.

Tech breakthroughs in fundraising: Shaping the future of VC strategies

Technological advancements have fundamentally altered fundraising strategies in the VC sector. The integration of technology in fundraising processes has led to:

- Greater efficiency and speed: Automation of routine tasks and data management, allowing VC firms to focus on strategic aspects of raising funds.

- Enhanced data-driven decision-making: The ability to analyze extensive data sets provides deeper insights into market trends, investor preferences, and investment opportunities, enabling more targeted and effective fundraising campaigns.

- Improved investor relations: Facilitating better communication and relationship management with potential investors by fostering trust and transparency, which are critical in securing investments.

Tools as catalysts in fundraising

The selection of appropriate technological tools can be a game-changer in the highly-fought world of venture capital. The right set of tools streamlines the entire fundraising journey by bringing proficiency and precision to a traditionally cumbersome process.

Harnessing automation for fundraising efficacy

The integration of the right technological tools into the fundraising process brings about a fundamental shift in how VC firms operate. Here’s what you can expect:

- Automated workflow management: The right tools automate various aspects of the fundraising process, from managing investor contacts to tracking the progress of discussions. Automation reduces the manual labour, allowing teams to focus on strategy and relationship building.

- Centralized data storage: By centralizing data, these tools ensure easy access to crucial information, which is vital for making timely and informed decisions. This centralized approach simplifies the management of vast amounts of investor data and interactions.

The power of specialized software in fundraising dynamics

Incorporating specialized software in fundraising processes leads to significant efficiency gains and operational improvements.

- Time savings: Specialized fundraising software significantly reduces the time spent on administrative tasks. By streamlining processes such as due diligence and investor reporting, VC firms can move faster in the fundraising cycle.

- Data-driven insights: These tools often come equipped with analytics capabilities that offer valuable insights into fundraising strategies. They can highlight what’s working and what’s not, enabling firms to optimize their approach in real time.

- Enhanced investor engagement: Modern fundraising tools facilitate more effective communication with potential investors. Features like personalized email campaigns, investor portals, and real-time updates help keep investors engaged and informed.

Zapflow: Revolutionizing VC fundraising

Zapflow stands out as a game-changer for venture capitalists by offering a suite of features specifically tailored to tackle the unique challenges of raising funds.

Zapflow is your strategic ally in fundraising. Its platform is engineered to manage all fundraising activities seamlessly, ensuring that every lead is nurtured and no opportunity is overlooked. Key features include:

- Improved investor relationships: Fostering strong connections with potential investors through streamlined communication and relationship management.

- Enhanced data management: By offering a centralized hub for all fund data, Zapflow simplifies data access and management to enable informed investment decisions.

- Customized solution: Tailoring the fundraising pipeline to align with diverse team workflows and specific data requirements.

Tackling fundraising challenges: The Zapflow advantage

Zapflow stands out for its ability to address the multifaceted fundraising challenges in the venture capital world. Its comprehensive suite of features is designed to cater to the diverse needs of VC firms, enhancing both productivity and proficiency in fundraising efforts.

- Transparent communication: Zapflow facilitates collaboration among team members and external stakeholders during capital-raising activities. It allows for managing distinct team access rights and ensures structured communication for effective progression tracking.

- Centralized data hub: As a unified platform, Zapflow provides access to deals, holdings, and fundraising activities for a comprehensive overview of all fundraising opportunities.

- Seamless configuration: Because it recognizes the diversity in team processes, Zapflow offers flexibility to customize the fundraising pipeline, making it easy to tailor, rename, or restructure stages according to the fund's needs.

- Streamlined fundraising process: Zapflow’s fundraising pipeline is designed for simplicity and optimal use, enabling smooth transitions of opportunities through various stages.

- Dynamic activity section: The platform meticulously records all changes and updates to ensure data integrity and provide a reliable history of fundraising efforts.

- Easy collaboration and data management: With features like an editable grid and bulk edit functionalities, Zapflow streamlines data entry and management tasks by optimizing time efficiency and operational organization.

Charting the path to fundraising excellence

The journey through the intricacies of asset management fundraising highlights the transformative power of the right technological tools. In an industry where streamlined operations, precision, and speed are paramount, these tools are catalysts for success. They optimize the fundraising process and facilitate data-driven decisions, enabling VC firms to navigate the complex terrain with enhanced agility and effectiveness.

Zapflow is a testament to how innovative solutions can accelerate fundraising efforts. Its comprehensive suite of features is tailored to meet the unique challenges of VC fundraising and ensures firms can operate more productively, engage investors more effectively, and close funds faster.

Embracing tools like Zapflow is a step towards future-proofing your fund. As the VC world continues to evolve, adopting such innovative solutions will be integral to the success of future funds. It's an investment in efficiency and growth, ensuring that your firm remains at the forefront!

Get in touch today!