Operational Due Diligence (ODD) is a forward-looking process that evaluates a target company's ability to grow and deliver value under new ownership. Unlike financial due diligence, which focuses on historical performance, ODD examines areas like processes, leadership, technology, and compliance to identify risks and opportunities. This approach helps investors make informed decisions, avoid costly mistakes, and create actionable plans for post-acquisition improvements.

Key Takeaways:

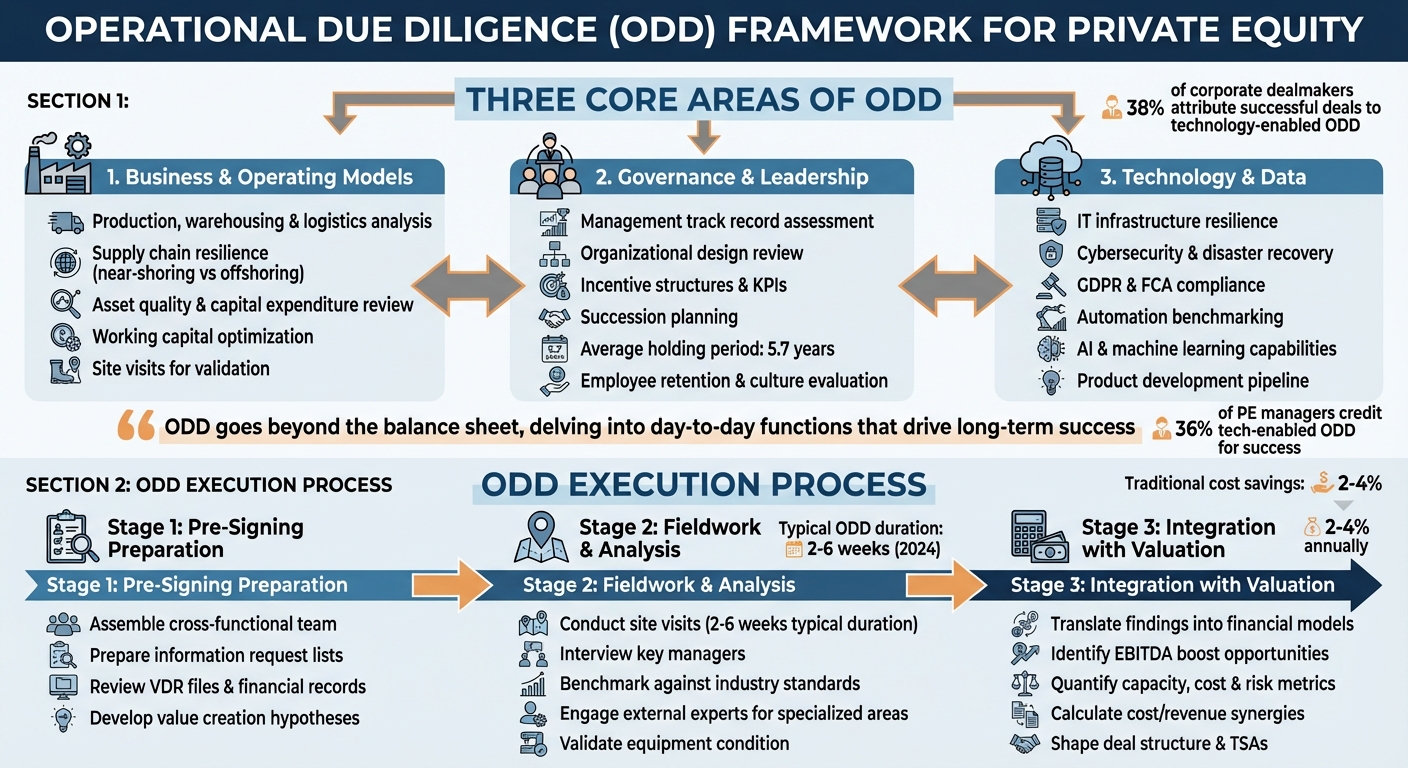

- Core Areas: ODD focuses on business models, leadership, and technology infrastructure to assess scalability and resilience.

- Execution: A structured approach involving pre-signing preparation, site visits, and integration of findings into valuation models ensures thorough analysis.

- Technology's Role: Advanced tools streamline ODD by centralising data, enabling real-time insights, and supporting continuous monitoring.

- Value Creation: Insights from ODD guide operational improvements, cost reductions, and strategic alignment during the first 100 days post-acquisition.

ODD is not just about identifying risks but also about developing strategies that maximise value and ensure long-term success.

Operational Due Diligence Framework: 3 Core Areas and Execution Process

The Importance of Operational Due Diligence

sbb-itb-d63e044

Core Areas of Operational Due Diligence

An effective operational due diligence (ODD) framework digs deeper than just financial metrics. It evaluates the operational backbone of a business, focusing on three key areas to determine whether a target company can deliver consistent value under new ownership.

Business and Operating Models

The first step is to determine whether the target's operating model can support future growth. This involves analysing production, warehousing, and logistics to ensure they align with the business plan. A close look at supply chain resilience is essential, especially when weighing the risks and benefits of near-shoring versus offshoring - an issue that’s becoming more pressing as global tariff pressures are set to rise in 2025.

Scrutinising asset quality and capital expenditure can reveal hidden investment backlogs or underestimated costs for essential technological upgrades. A detailed review of working capital - including inventory management and safety stock levels - can uncover opportunities to free up cash and boost EBITDA. Site visits are particularly valuable here, as they help validate data and may expose issues like equipment backlogs or other operational inefficiencies.

Governance and Leadership

A company’s leadership team plays a pivotal role in its success. Investors assess management’s track record, decision-making skills, and ability to execute plans effectively. Alongside this, the organisational design is reviewed to ensure clear reporting lines and alignment with strategic goals.

Incentive structures are another focus area - KPIs should drive continuous improvement and align with investor expectations. Succession planning, employee retention policies, and workplace culture are also critical factors in evaluating whether the business can maintain stability if key leaders leave. Interviews with department heads provide additional insight into decision-making processes and compliance practices. With portfolio companies now being held for an average of 5.7 years, ensuring long-term leadership stability has never been more important.

Technology and Data

The resilience of IT infrastructure is vital, particularly in ensuring systems can handle the demands of post-merger operations. Investors look at reliance on outdated hardware and assess cybersecurity measures, including disaster recovery plans and compliance with GDPR and FCA regulations. Automation levels are benchmarked against industry standards, while the product development pipeline is examined for potential risks or opportunities.

"Operational due diligence goes beyond the balance sheet, delving into the day-to-day functions that drive a company's long-term success." – Streamliners

Technology reviews are increasingly incorporating AI and machine learning capabilities. These tools help identify anomalies in financial data and predict performance trends, adding a new layer of insight to the due diligence process. By thoroughly evaluating these operational pillars, investors can ensure a more informed and effective approach to due diligence.

How to Plan and Execute Operational Due Diligence

Operational due diligence (ODD) is a critical process that demands a structured and efficient approach. Typically, ODD reviews span two to six weeks, depending on the complexity of the target company and the number of sites involved. The process begins with a focused hypothesis tied to your investment thesis. This approach helps zero in on the key deal questions and identifies which facilities or suppliers warrant a deeper dive. By linking risk identification to actionable insights, ODD ensures a more informed deal configuration.

Pre-Signing Preparation

Before signing a Letter of Intent (LOI), it’s essential to outline the scope of your ODD in line with your investment strategy. Start by assembling a cross-functional team that includes experts in operations, IT, and supply chain management. Prepare comprehensive information request lists covering areas like human capital, operational infrastructure, regulatory compliance, and supply chain resilience. This groundwork ensures you’re ready to act swiftly once the LOI is signed.

"ODD clarifies overlooked risks and value potential." – KPMG

The initial assessment focuses on reviewing virtual data room (VDR) files, financial records, and regulatory filings to identify potential red flags. Use this phase to develop hypotheses about value creation opportunities, such as cost reduction, automation, or supply chain improvements. Unlike financial due diligence, which looks backward, ODD takes a forward-looking approach to uncover future potential.

Fieldwork and Analysis

Site visits are a cornerstone of ODD, allowing you to validate findings from documents. These visits often uncover issues like unreported bottlenecks, manual workarounds, or equipment that’s in poorer condition than reported. Assess whether production lines and warehouses are equipped to meet the growth targets outlined in the business plan without requiring significant reinvestment.

Conversations with key managers are equally important. These interviews shed light on decision-making processes and operational responsibilities. To quickly identify inefficiencies, benchmark functional performance, headcount, and costs against industry standards.

"Operational due diligence typically comprises three steps: Identifying operational risks in the target company; Assessing the scalability of organisational and operational (core) processes; Quantifying value-creation potential." – Raphael Maccagnan, Partner, Leader Private Equity, EY Parthenon Switzerland

For specialised areas like cybersecurity, regulatory compliance, or unique manufacturing processes, consider bringing in external experts. Field visits also help verify the condition and maintenance needs of equipment. Additionally, evaluate whether recent performance is the result of a cohesive team effort or overly reliant on a single key individual.

Integration with Valuation and Deal Structuring

Once on-site analyses are complete, the next step is to integrate your findings into financial models. Translate operational insights into adjustments to the purchase price. Pinpoint specific opportunities to boost EBITDA and optimise working capital through value chain improvements. Examine historical and planned capital expenditures to identify any investment backlogs or underestimated future costs.

Quantify your observations into metrics for capacity, cost, and risk, feeding these into valuation models. Collaborate closely with finance teams to calculate cost/revenue synergies, one-off implementation expenses, and additional cost-reduction opportunities. Finally, use these findings to shape the deal structure, including Transition Service Agreements and post-close integration strategies.

Using Technology to Improve Operational Due Diligence

Modern operational due diligence (ODD) increasingly relies on advanced technology solutions. Recent data shows that 38% of corporate dealmakers and 36% of private equity managers attribute successful deals to technology-enabled ODD processes. With the median holding period for portfolio companies reaching around 5.7 years as of 2024, firms require tools that not only support pre-acquisition evaluations but also provide continuous monitoring throughout ownership. This growing demand underscores the importance of centralised workflow systems that bring all facets of ODD under one roof.

Centralised Workflow Management

A centralised platform ensures operational data remains consistent, accessible, and easy to manage. Instead of navigating endless email threads to track documents, platforms like Zapflow serve as a single source of truth. Here, all stakeholders - investors, advisors, and management - can access the same real-time data. Additionally, integrated Q&A modules simplify information requests, ensuring accountability through structured workflows.

The benefits of these platforms are clear. Features such as bulk uploads, full-text search with OCR, and automatic index numbering speed up the document review process. Sensitive data, like technology blueprints, operating procedures, and compliance records, is safeguarded with granular permissions. Moreover, teams can customise workflows and checklists to align with the specific deal rationale, industry dynamics, and operational risks of the target company.

Real-Time Insights and Reporting

Visual dashboards and colour-coded trackers transform raw data into actionable insights, helping teams identify operational bottlenecks early. For example, Zapflow's LP Portal offers a user-friendly visualisation of complex investment data and operational KPIs. This transparency not only makes findings more accessible but also builds trust through on-demand reporting.

Real-time monitoring tools take risk management a step further. By identifying issues like compliance gaps, supply chain vulnerabilities, or operational inefficiencies early, deal teams can make informed decisions about valuation or deal structuring. Benchmarking features compare metrics like headcount and IT costs against industry standards using proprietary data, offering an additional layer of analysis.

Continuous Monitoring and Compliance

ODD doesn’t stop once the deal is signed. Technology now enables firms to continuously monitor operational improvements and manage risks throughout the investment period. Real-time insights ensure that progress in operations and regulatory compliance is sustained long after acquisition. This shift - from a one-off pre-signing task to an ongoing process - makes monitoring KPIs, vendor stability, and regulatory adherence a standard practice.

Automated tools also create real-time audit trails, flagging potential security breaches or operational anomalies. With regulatory requirements expected to tighten in 2025, automated compliance tracking becomes essential, reducing the reliance on manual oversight. This ongoing diligence keeps operational documentation and performance metrics up to date, ensuring firms are well-prepared for eventual exits.

Applying ODD Findings to Value Creation and Post-Acquisition Plans

Operational Due Diligence (ODD) doesn't end once the deal is signed - it becomes the foundation for driving tangible improvements. As Deloitte highlights:

"ODD as part of the overall due diligence scope changes the lens from 'due diligence to lose' into 'due diligence to win'".

This approach shifts the focus from simply identifying risks to actively planning for success. It asks the critical question: "What are we going to do with this company when it is ours?". This mindset lays the groundwork for collaborative, value-focused strategies after acquisition.

Creating Value-Creation Plans

Using insights gathered during ODD, value-creation plans are developed in partnership with management. This collaboration ensures that the strategies are not only actionable but also aligned with the company's operational realities, fostering greater commitment from the team.

The first 100 days post-acquisition are pivotal. These plans often prioritise "quick wins" - initiatives that are impactful yet straightforward to execute. For example, a private equity firm worked with TBM Consulting to improve a tier-one automotive supplier's operations. ODD revealed inefficiencies in operating equipment efficiency (OEE). Post-acquisition, TBM introduced a daily management system to optimise cycle and changeover times, resulting in increased machine uptime and a measurable EBITDA boost.

While traditional cost-saving measures, such as procurement efficiencies, typically yield annual savings of 2% to 4%, more transformative actions can unlock much larger benefits. For instance, automating support functions with AI or near-shoring production can significantly lower costs. Functional benchmarking is a useful tool here, comparing headcount and costs across departments like Finance, HR, IT, and Marketing against industry benchmarks. Additionally, optimising working capital - through strategies like inventory reduction and adjusting safety stock - can release funds quickly.

| ODD Focus Area | Value Creation Strategy | Measurable KPI/Outcome |

|---|---|---|

| Purchasing/Procurement | Supplier consolidation and price negotiations | Lower purchasing costs; % of spend with alternative suppliers |

| Human Capital | Functional cost benchmarking | Streamlined organisational structure; reduced SG&A as % of revenue |

| IT & Technology | AI integration and automation | Higher production throughput; fewer manual labour hours |

| Working Capital | Adjusting inventory and safety stock levels | Increased free cash flow; fewer inventory turnover days |

| Production/Operations | Reducing cycle and changeover times | Enhanced OEE; EBITDA growth |

Once these initial changes are in place, continuous monitoring ensures the improvements are sustained and scaled over time.

Portfolio Monitoring and Exit Readiness

With the average holding period for portfolio companies now around 5.7 years as of 2024, consistent monitoring becomes critical. This process ensures that the improvements identified during ODD are not just implemented but maintained throughout the investment lifecycle.

Setting baseline standards for compliance and operational programmes across the portfolio ensures consistency, while enhanced reporting - shaped by ODD findings - provides ongoing visibility into performance and risk management. A track record of steady performance, supported by structured monitoring, makes portfolio companies more appealing and "exit-ready" when it's time to divest.

"While it is impossible to eliminate all risks involved with any investment, a strong operational due diligence programme can help mitigate such risks and provide investors with valuable insight to help them make investment decisions." - Craig Horvath, Principal Consultant, Performance Measurement Solutions

Conclusion

Operational Due Diligence (ODD) has grown beyond its original purpose as a simple risk assessment. Today, it serves as a forward-thinking strategy aimed at creating value. Unlike financial or legal due diligence, which tend to focus on past performance, ODD looks ahead. It doesn’t just ask, "What could go wrong?" but also, "How can we make things better?". This proactive mindset often distinguishes successful private equity investments from those that falter after acquisition.

The numbers back this up. With the average holding period for portfolio companies now at 5.7 years, effective ODD lays the groundwork for continuous oversight, value-building strategies, and a smoother exit. Limited Partners are increasingly demanding this level of diligence - not only to safeguard their investment but to ensure General Partners have a clear and actionable plan for growth.

Modern technology has made ODD even more efficient and impactful. Tools like Zapflow simplify the process by centralising sensitive documents, enabling real-time reporting, and offering features like visual data dashboards and audit trails. These platforms replace outdated methods, such as spreadsheets and email chains, with streamlined, actionable insights that investment teams can rely on.

Recent high-profile deals serve as a reminder that even the most promising opportunities can harbour risks that thorough ODD might reveal. Identifying and addressing these red flags is not just possible - it’s essential.

Ultimately, ODD is far from a box-ticking exercise. It’s about crafting a strong investment thesis built on operational realities. Whether it’s evaluating scalability, planning the critical first 100 days post-acquisition, or preparing a company for exit, the insights gained during ODD become the cornerstone of long-term success. This strategic focus ensures ODD remains a vital tool for achieving sustainable investment outcomes.

FAQs

How is operational due diligence different from financial due diligence in private equity?

Operational due diligence (ODD) dives into the inner workings of a business to assess whether it can continue to thrive and grow under new ownership. It scrutinises areas like processes, technology, workforce, compliance measures, and supply chains. The goal? To spot risks and uncover opportunities for improvement. Key questions often include: Can this business maintain efficiency after acquisition? and What operational tweaks could boost EBITDA?

On the other hand, financial due diligence zeroes in on the numbers - reviewing historical financial data like past performance, cash flow, and debt levels. Its purpose is to verify the figures that underpin the valuation. While financial due diligence ensures the purchase price aligns with past results, ODD focuses on identifying operational risks and potential value-creation strategies that can fuel future growth. Combined, these approaches give private equity investors a well-rounded view of the investment opportunity.

How can technology improve operational due diligence in private equity?

Technology has become a game-changer in operational due diligence (ODD), turning laborious, manual tasks into streamlined, data-driven processes. Modern tools now let investment teams centralise critical information - like supplier contracts, KPIs, and process maps - into a single, easily searchable system. This not only makes gathering and validating data quicker but also boosts transparency for stakeholders, cutting down on both time and effort.

Features such as real-time reporting and AI-driven analytics empower investors to spot operational risks, compare performance benchmarks, and pinpoint opportunities to add value - all before deals are finalised. Secure collaboration tools further ensure that teams, regardless of location, can work together efficiently, with the latest data always at their fingertips. With these advancements, private equity teams can make faster decisions, lower risks, and meet the stringent governance standards expected in the UK market.

What are the essential steps for effective operational due diligence in private equity?

Operational due diligence (ODD) plays a key role in assessing a target company's operations, focusing on both capabilities and potential risks. The process begins by defining the scope and objectives in line with the investment strategy. A solid plan should include assembling a capable team, setting achievable timelines, and identifying the data and information required for evaluation.

ODD typically involves gathering and analysing operational data, visiting sites, interviewing key personnel, and comparing processes and technologies against industry benchmarks. Through this, investors can pinpoint areas for improvement, such as reducing costs or increasing efficiency, and develop a clear action plan to address these opportunities. The findings are then summarised in a concise report, outlining risks and areas where value can be added.

Leveraging tools like Zapflow can make the process smoother. By centralising data, tracking progress, and supporting collaboration, such tools help streamline the work, enabling investors to make confident, well-informed decisions.