The importance of Environmental, Social, and Governance (ESG) reporting in the current investment environment simply can't be overstated. As a strategic asset, ESG reporting influences investor decisions, shapes brand reputation, and underscores a company's commitment to societal values. This focus reflects a broader shift towards sustainability and accountability in the business world, positioning ESG reporting as a pivotal element of modern corporate strategy.

Despite its importance, the ESG reporting journey is laden with challenges. Companies grapple with issues ranging from complex data collection and compliance hurdles to security concerns.

This article delves into the common pitfalls encountered during the ESG reporting process and demonstrates how Zapflow's integrated solutions can address these issues effectively. By streamlining the ESG reporting process, Zapflow ensures companies can meet their sustainability goals with greater efficiency, compliance, and stakeholder engagement.

Lack of integrated reporting tools

The fragmentation of tools in ESG reporting processes often results in significant inefficiencies for companies. It can lead to the duplication of efforts, inconsistencies in data collection and reporting, and ultimately, a more time-consuming and costly process. The problem stems from the use of disparate tools for collecting, validating, and reporting ESG data, which can hinder a company's ability to present a cohesive and comprehensive ESG narrative to stakeholders.

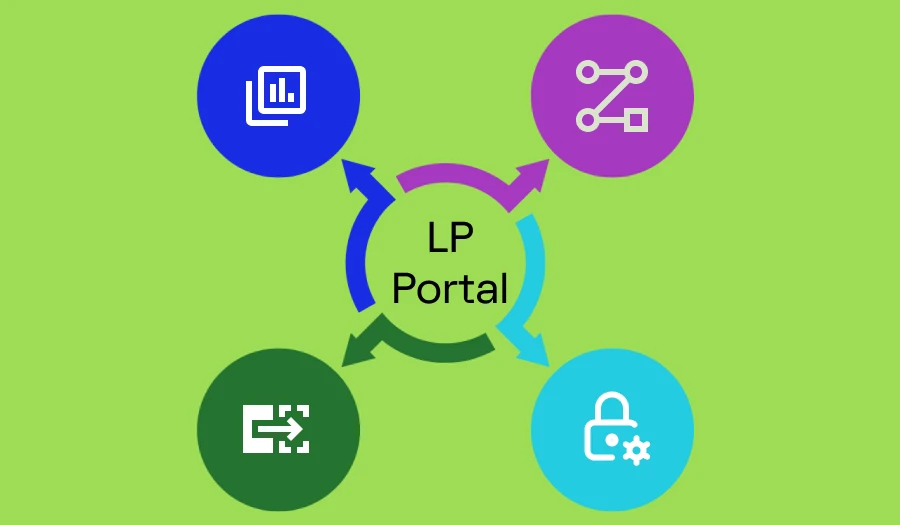

Zapflow’s integrated reporting solution addresses these challenges head-on by offering an all-in-one platform that consolidates ESG reporting with other essential portfolio data. This integration eliminates the need for separate ESG reporting platforms, thereby reducing maintenance and coordination work significantly. By centralizing data collection and reporting processes, Zapflow ensures companies can efficiently manage their ESG data. This leads to more streamlined operations and improved accuracy in reporting.

Zapflow's approach also minimizes the administrative burden associated with managing multiple reporting tools. By providing a single, comprehensive platform for all ESG reporting needs, it allows companies to easily access and analyze their data to make informed decisions and effectively communicate their ESG performance to investors and other stakeholders. The integrated nature of this solution simplifies the reporting process and enhances the overall quality and reliability of ESG data presented.

Data collection and validation difficulties

Data collection and validation are pivotal yet challenging aspects of ESG reporting. Traditional methods often involve manual data entry and validation processes that are time-consuming and also prone to errors. This is further complicated by inconsistent data formats across different sources, making it difficult to aggregate and analyze the information effectively. These challenges can significantly hinder a company's ability to accurately report on its ESG initiatives and outcomes.

Zapflow directly confronts these challenges by transforming the data collection process with its ESG surveys. These surveys are designed to simplify data collection by ensuring data validation at the point of entry, which significantly reduces the need for manual validation post-submission. By standardizing data formats, Zapflow ensures all responses are consistent and easily comparable and streamlines the analysis and reporting process.

Zapflow's surveys also offer the flexibility to control what information needs to be inputted by portfolio companies, ensuring only relevant and necessary data is collected. This saves time and enhances the quality of the data collected. With Zapflow, the sender of the ESG survey can see what has been answered previously, making it easier to track progress over time and identify areas of improvement.

KYC and compliance hurdles

Integrating KYC processes with ESG reporting presents a unique set of challenges, notably around ensuring compliance and managing expired KYC information. These hurdles can significantly impact the efficiency and reliability of ESG reporting, making it difficult for companies to maintain consistent and compliant data practices.

Zapflow addresses these hurdles by seamlessly integrating KYC processes into its ESG reporting tools. This integration ensures compliance with regulatory standards and automates KYC checks when distributing ESG surveys. By doing so, it guarantees that all ESG data collection adheres to the necessary compliance requirements, thereby mitigating the risk of non-compliance.

Zapflow's system alerts users when KYC information is due to expire or has already expired, providing an opportunity to automatically trigger the KYC renewal process. This proactive approach ensures all data collected through ESG surveys is always backed by current and compliant KYC information. This reinforces the integrity of the reporting process.

By automating these critical compliance checks and integrating them within the ESG reporting workflow, Zapflow simplifies what could otherwise be a complex and cumbersome process. This saves time and also ensures that companies can focus on the substantive aspects of their ESG reporting, confident in the knowledge that their compliance needs are being managed effectively.

Security concerns in data handling

Security concerns in ESG reporting, particularly unauthorized access and data breaches, pose significant risks to the integrity and confidentiality of sensitive data. Traditional survey tools and data collection methods often fall short in addressing these security challenges, leaving data vulnerable to exploitation.

Zapflow addresses these security concerns comprehensively by implementing a range of authentication options that significantly enhance the security of data handling. With features like link-only access, link plus SMS verification, email plus SMS verification, and even bank identification, Zapflow provides a robust security framework that minimizes the risk of unauthorized access. This multi-layered approach safeguards sensitive ESG data against potential breaches by ensuring only authorized personnel can access it.

Zapflow offers fine-tuned control over access rights, a feature often lacking in conventional survey tools. This enables organizations to specify who can view or edit ESG data, ensuring access is restricted based on roles and responsibilities within an organization. This level of control enhances data security and ensures compliance with relevant data protection regulations.

Inflexibility of survey structures

The traditional ESG reporting process often encounters a significant hurdle with the inflexibility of survey structures. Standard survey formats can be rigid and not conducive to nuanced differences across companies and industries. This one-size-fits-all approach can lead to irrelevant questions, inadequate data collection, and reports that don't fully capture a company's unique ESG efforts or challenges. Such rigidity makes it difficult for companies to report on their ESG initiatives accurately and can hinder meaningful analysis and improvement.

Zapflow's solution to this common pitfall is to introduce unparalleled flexibility in survey design. The platform allows for the customization of questions, the creation of tailored templates, and the organization of these into template groups, thus accommodating the specific reporting needs of any company or industry. This flexibility ensures that the ESG reporting process is more relevant and engaging for companies.

Zapflow's adaptable survey structure facilitates a more streamlined and effective ESG reporting process. Companies can align their reporting with specific ESG criteria relevant to their operations, ensuring the data collected is meaningful and actionable. This approach simplifies the reporting process for companies and enhances the quality and utility of the ESG data collected.

Transforming ESG reporting: Overcoming common challenges with Zapflow

Navigating the intricate world of ESG reporting is fraught with challenges, from integrating KYC processes and handling data security concerns to overcoming the limitations of rigid survey structures. Companies face hurdles like fragmented reporting tools, manual data validation issues, and compliance complexities that can significantly hinder their ability to effectively report on environmental, social, and governance factors.

For organizations aiming to efficiently tackle these common pitfalls, Zapflow emerges as a premier choice. Its all-in-one platform offers an integrated solution that simplifies ESG reporting, ensuring compliance and security and providing the flexibility needed to meet unique company and industry requirements.

For those ready to transform their ESG reporting process, reach out to us to explore how Zapflow can streamline your efforts!

Get in touch today!